Deposits

Our new Deposits API is designed to focus on simplicity, usability, and personalization. Its main role is to facilitate deposits by your customers using their preferred local payment methods.

We act as an intermediary connecting you with your customers' local payment options, including banks, e-wallets, and credit cards. This API gives you access to the most prevalent payment methods in emerging markets through a single integration.

To achieve this, we have designed our Deposits API to issue payment requests directly from your cashier interface. Alternatively, you can use our cashier interface to manage the specific requirements of each country and payment method, simplifying the process for you.

Solution

Our singular API streamlines the process of collecting, validating, and transmitting all necessary details for a payment. This lets you display the payments' metadata directly on your website or redirect customers to a designated payment page.

This integration is designed to facilitate the submission of all essential details required for the deposit, including customer details. In response, we provide you with the payment metadata, enabling you to construct the payment page on your website. Alternatively, we supply a URL that directs the customer to the payment page. This dual approach ensures a seamless and efficient payment process tailored to your specific needs.

With this integration, it is recommended to prompt your customers to provide their details only once. These details should then be securely stored in your database. This approach eliminates the need to repeatedly request the same information from customers for subsequent transactions. Instead, you can send us the information directly from your database. If there is a need for changes, making them in the user profile settings, and not during transactions on your cashier interface is recommended. This method improves the efficiency and user experience of your payment process.

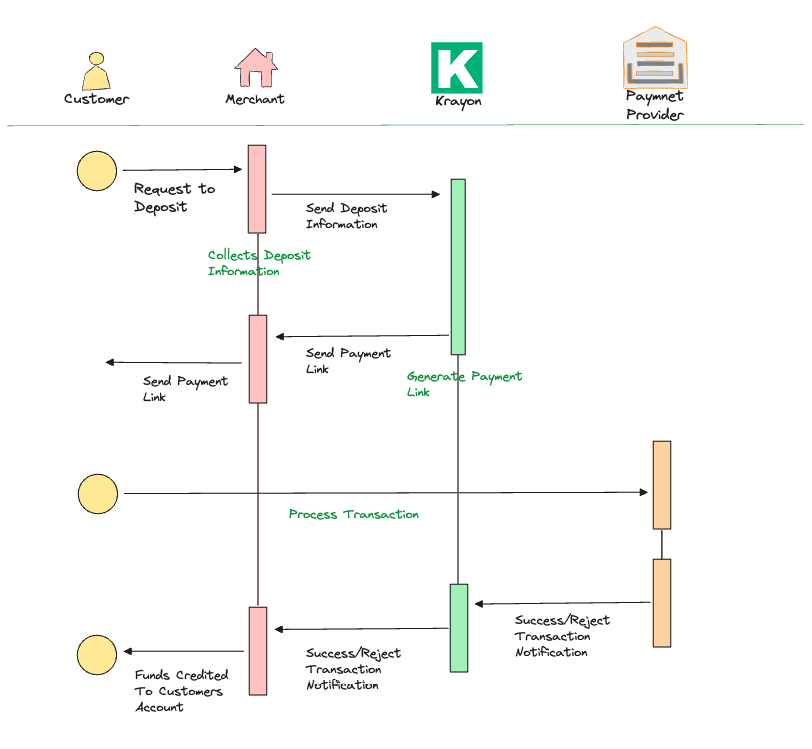

Process Flow

Deposits Flow

Updated 9 days ago